Do You Pay Prorated Taxes At Closing are a hassle-free and budget-friendly tool to stay organized. Whether you require a monthly, weekly, or yearly layout, these calendars are perfect for tracking visits, due dates, and occasions. They're easy to download, print, and usage, providing an adjustable service for personal and expert preparation. With various styles available, you can choose a design that matches your preferences or work area.

The accessibility of Do You Pay Prorated Taxes At Closing makes them an ideal choice for anyone looking for practical preparation tools. Numerous websites provide templates customized to particular needs, from academic schedules to physical fitness tracking. These calendars help you remain on top of your tasks while including a personal touch to your planning routine. Start exploring free printable calendars today to manage your time efficiently and make preparing a seamless experience.

Do You Pay Prorated Taxes At Closing

Do You Pay Prorated Taxes At Closing

Happy Birthday Dad Coloring Pages On this page you will find 15 all new Happy Birthday Dad coloring pages that are completely free to print and download Use our ready-made, printable birthday card templates to send warm wishes on someone's special day.

33 Awesome Printable Birthday Cards for Dads FREE Pinterest

How To Calculate Property Tax Prorations Ask The Instructor YouTube

Do You Pay Prorated Taxes At ClosingGet nine different happy birthday dad coloring pages that any dad would love to get on their birthday. Choose one or get them all. On this page you will find 15 all new Happy Birthday Dad coloring pages that are completely free to print and download

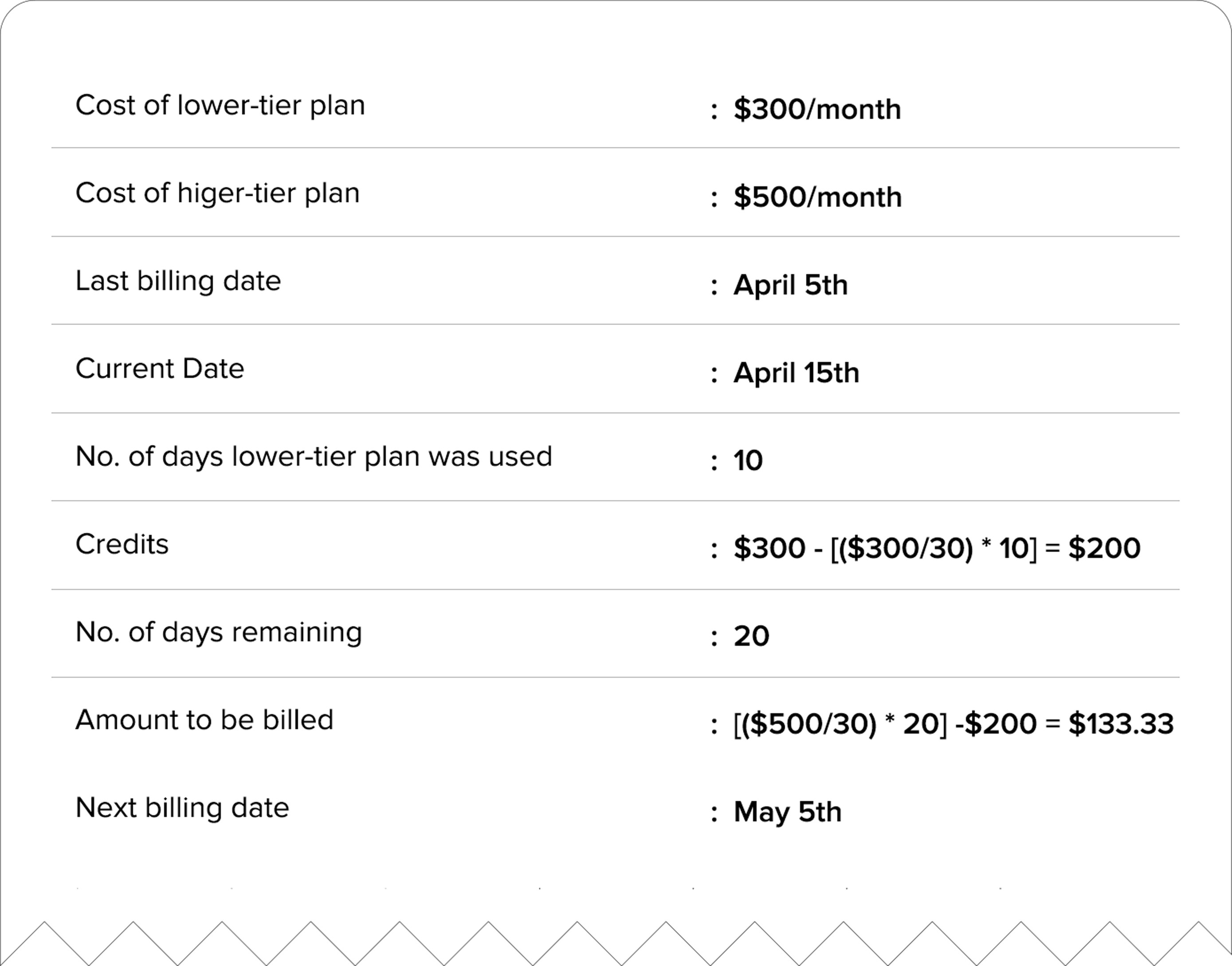

Enjoy an artist-designed birthday card template to create a perfect happy b-day card for your day. Use a free online editor to make all the necessary changes ... Sample Authorization Letter Philippines What Are Prorated Charges EBizCharge

Free custom printable birthday card templates Canva

Are Property Taxes Prorated At Closing In Georgia YouTube

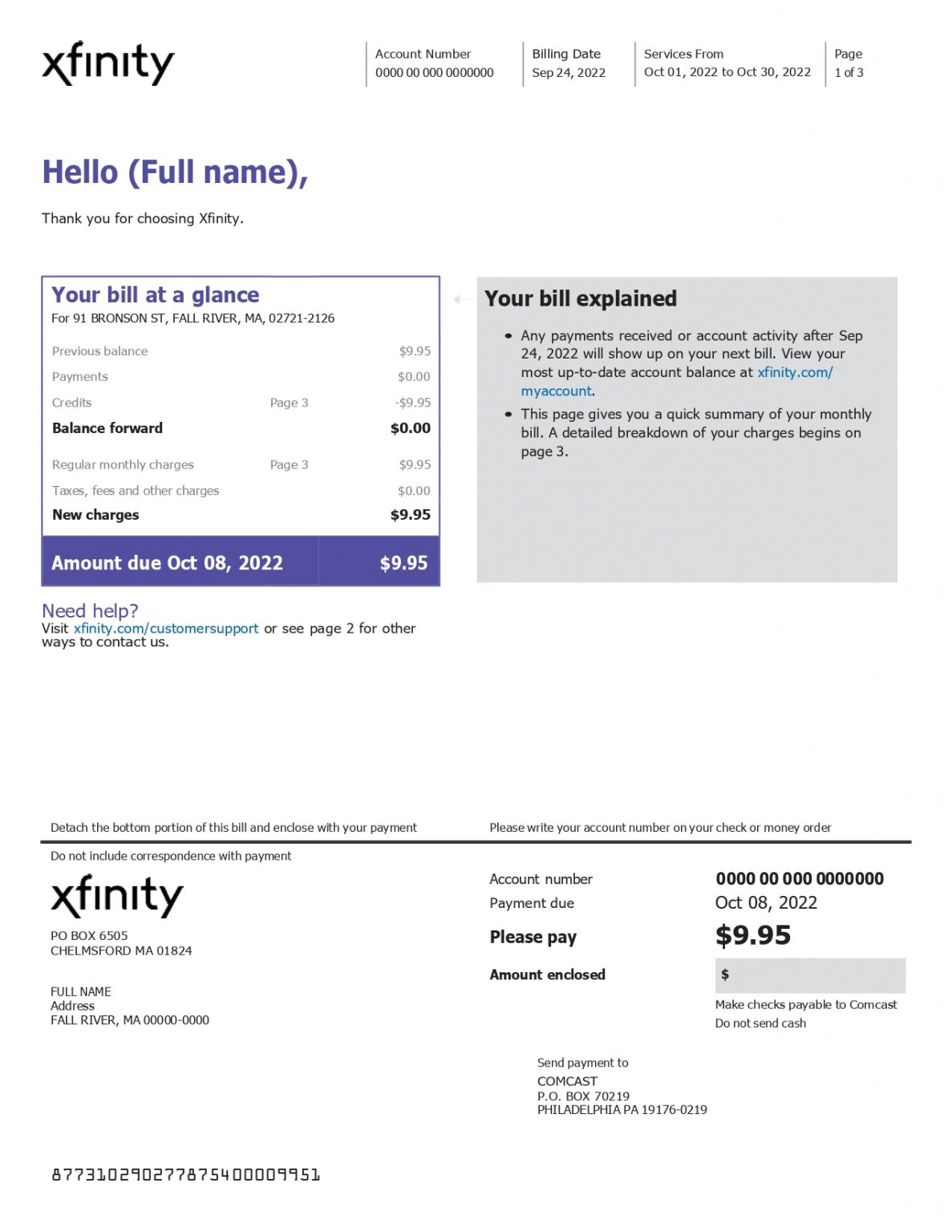

Check out our printable dad birthday card selection for the very best in unique or custom handmade pieces from our shops Xfinity Bill 2024 Merna Stevena

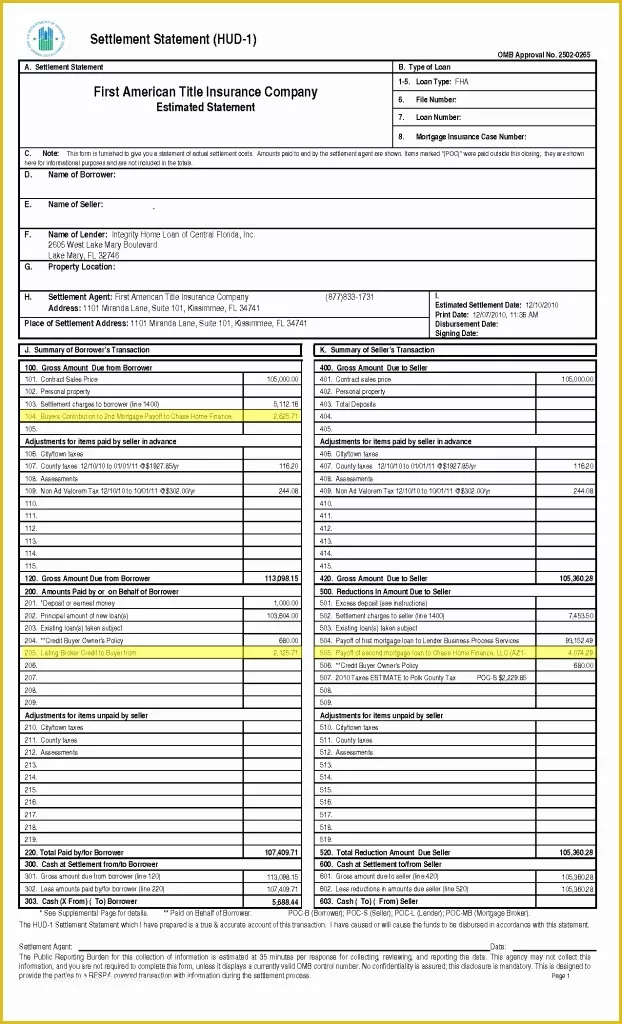

Printable Birthday Card For Dad Happy Birthday Dad Rarest Steak Digital Download Rare Steak Instant Download How To Compute 13th Month Pay 13th Month Pay Months Computer How Do Taxes Get Prorated At Closing RealClear Settlement And Exchange

Real Estate Tax Prorations A Florida Real Estate Exam Math Tutorial

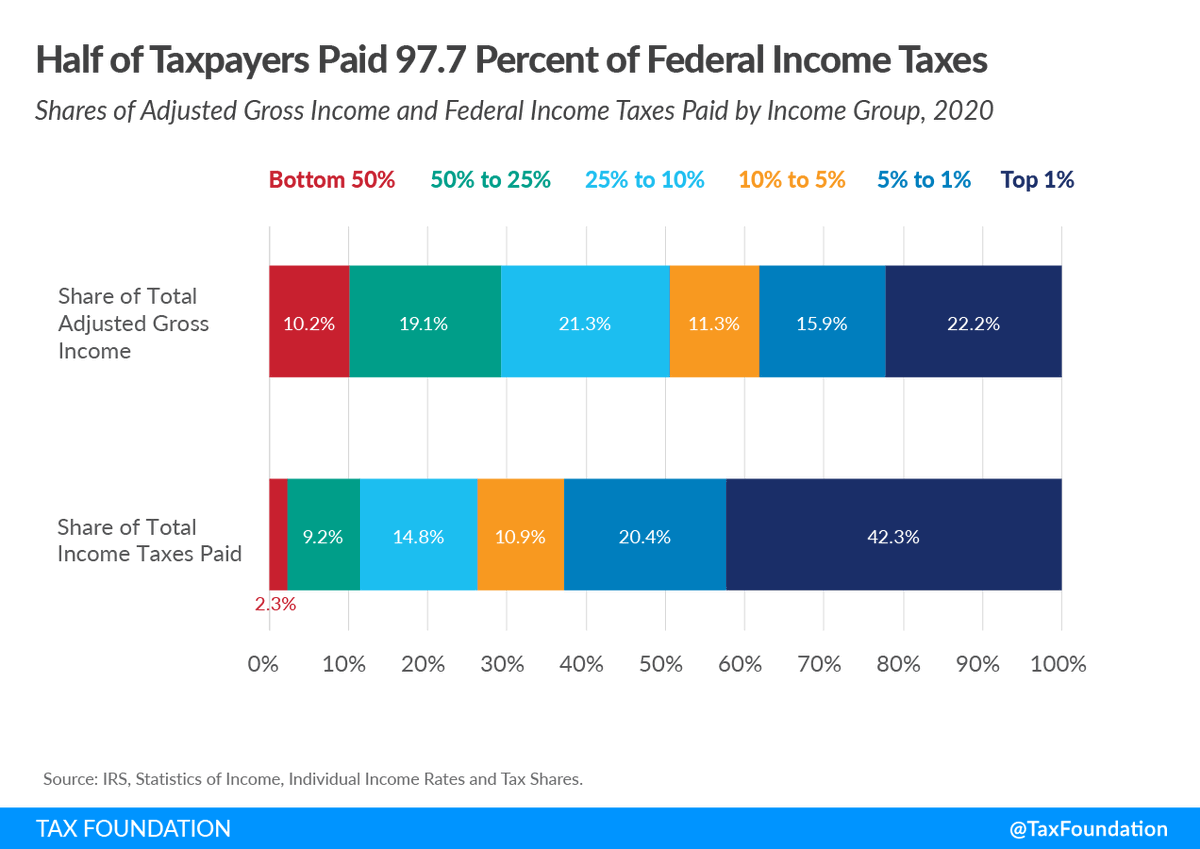

Tax Foundation On Twitter Who Pays Federal Income Taxes Summary Of

Homes For Sale Royal Shell Real Estate

Iowa s High Property Taxes ITR Foundation

Prorated Calculator

What Is A Seller s Closing Cost In Missouri Sapling

Settle Statement Proof

Xfinity Bill 2024 Merna Stevena

Higher Rate Dividend Tax 2025 25 Zaidah Noor

Are You Looking For A Coweta County School System Facebook