45 Days After Invoice Date are a convenient and budget-friendly tool to remain arranged. Whether you require a monthly, weekly, or yearly layout, these calendars are perfect for tracking consultations, due dates, and occasions. They're simple to download, print, and usage, using a customizable option for personal and expert planning. With various styles readily available, you can select a design that matches your choices or workspace.

The accessibility of 45 Days After Invoice Date makes them an ideal option for anybody seeking useful planning tools. Numerous websites offer templates customized to particular needs, from scholastic schedules to physical fitness tracking. These calendars assist you stay on top of your tasks while including a personal touch to your planning routine. Start exploring free printable calendars today to manage your time efficiently and make preparing a seamless experience.

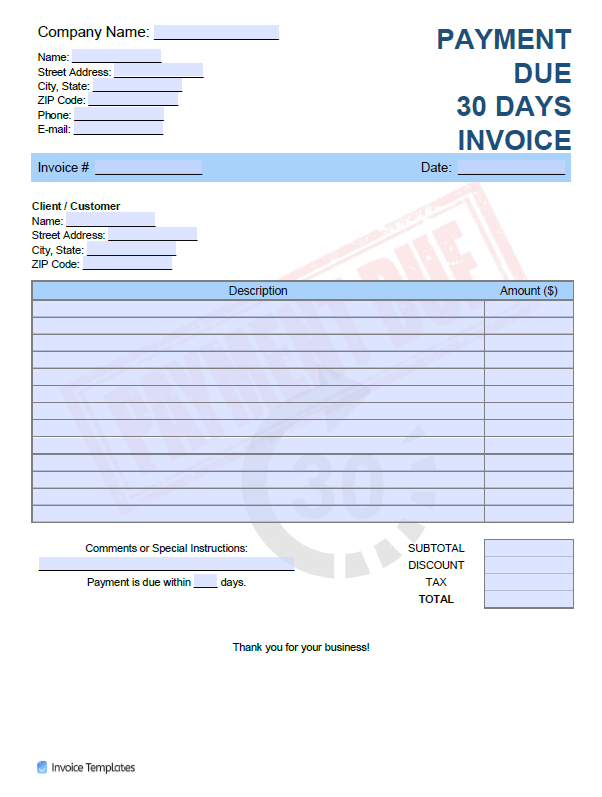

45 Days After Invoice Date

45 Days After Invoice Date

Use the duck templates to give flight to your imagination These are ideal for artists kids teachers and almost everyone else conceivable This free printable rubber duck coloring worksheet helps your child to work on their scissor skills, colouring, focus and creativity.

Printable Rubber Duck Template Pattern Universe

Fill

45 Days After Invoice DateFree printable baby duck template for preschoolers to develop creativity and motor skills. Use as a stencil for art projects or decorations. Download now! This free printable baby duck cut out template is super cute and makes for an easy preschool craft to teach about the letter D or just a simple coloring

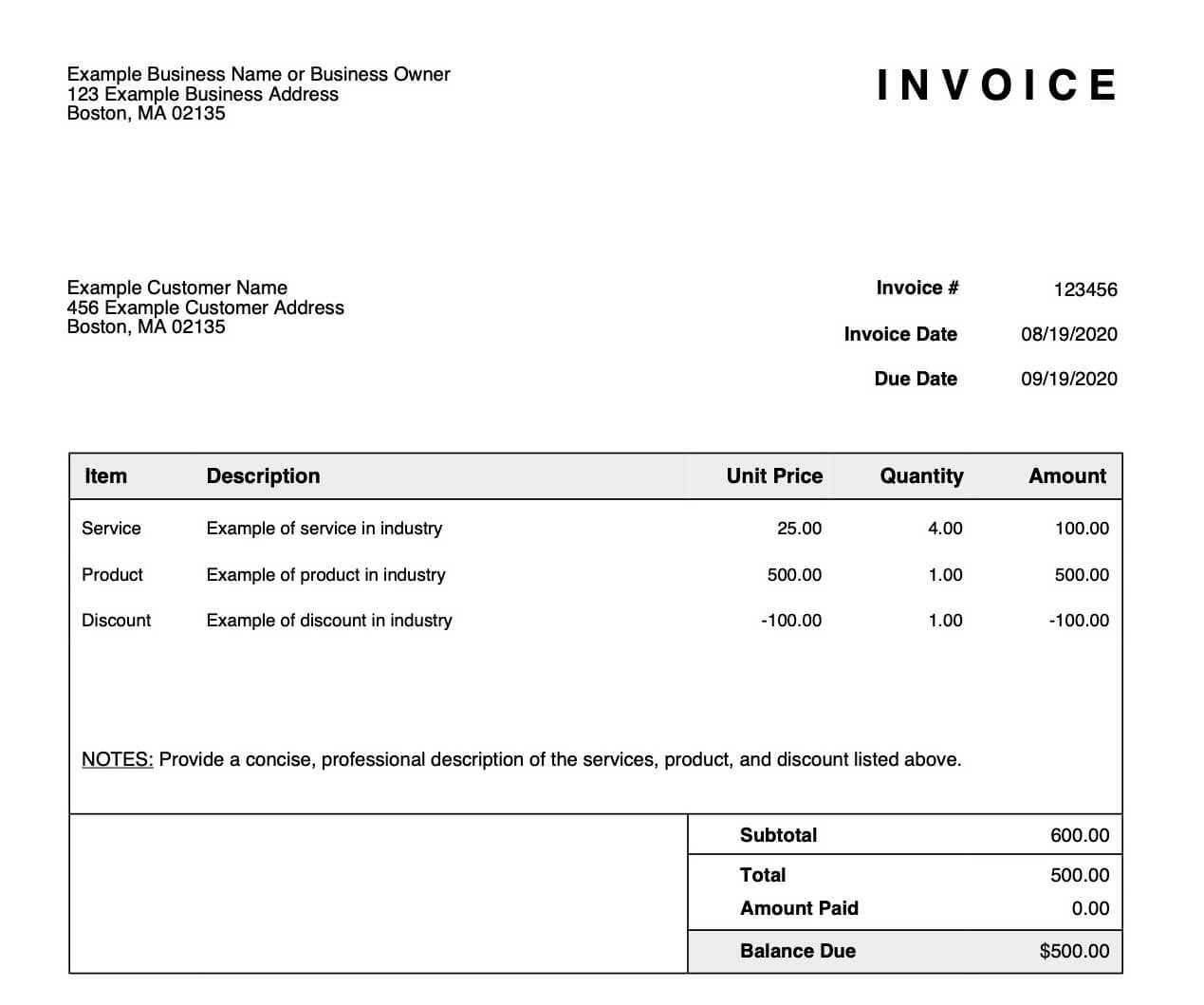

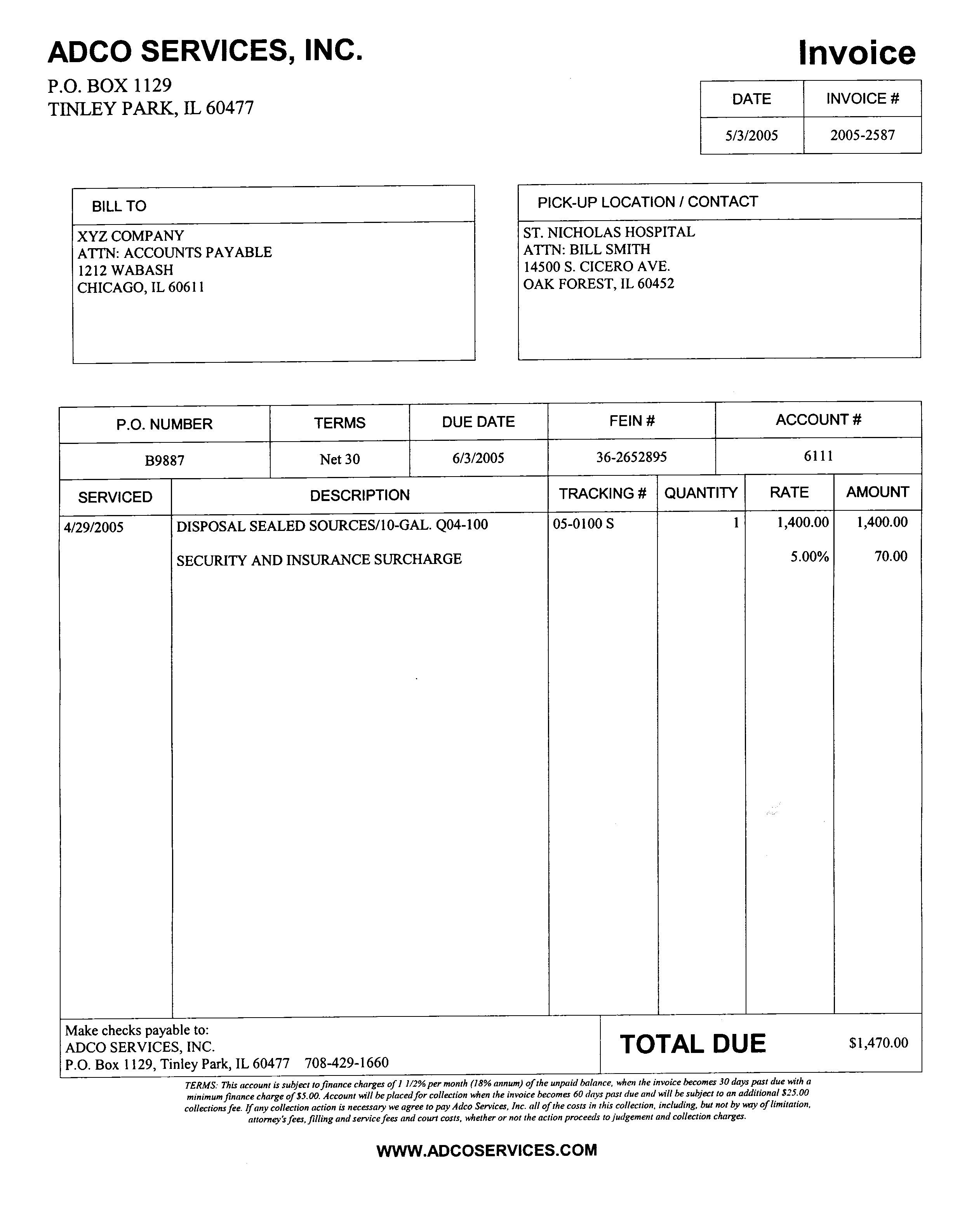

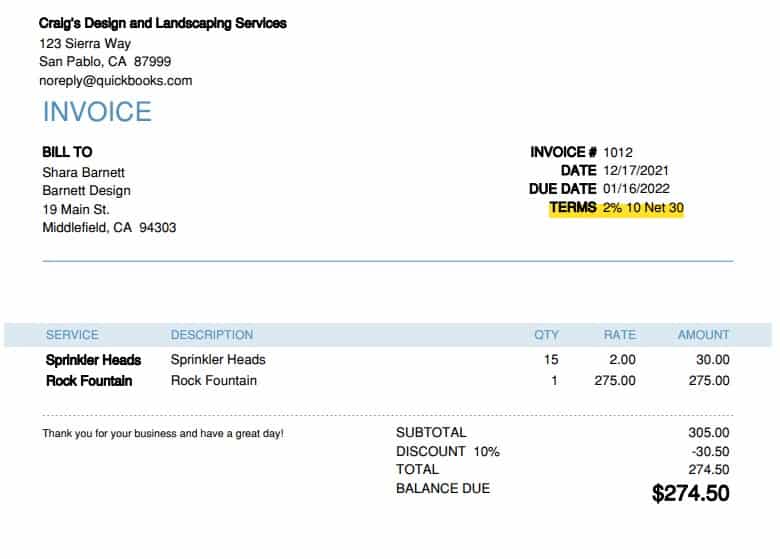

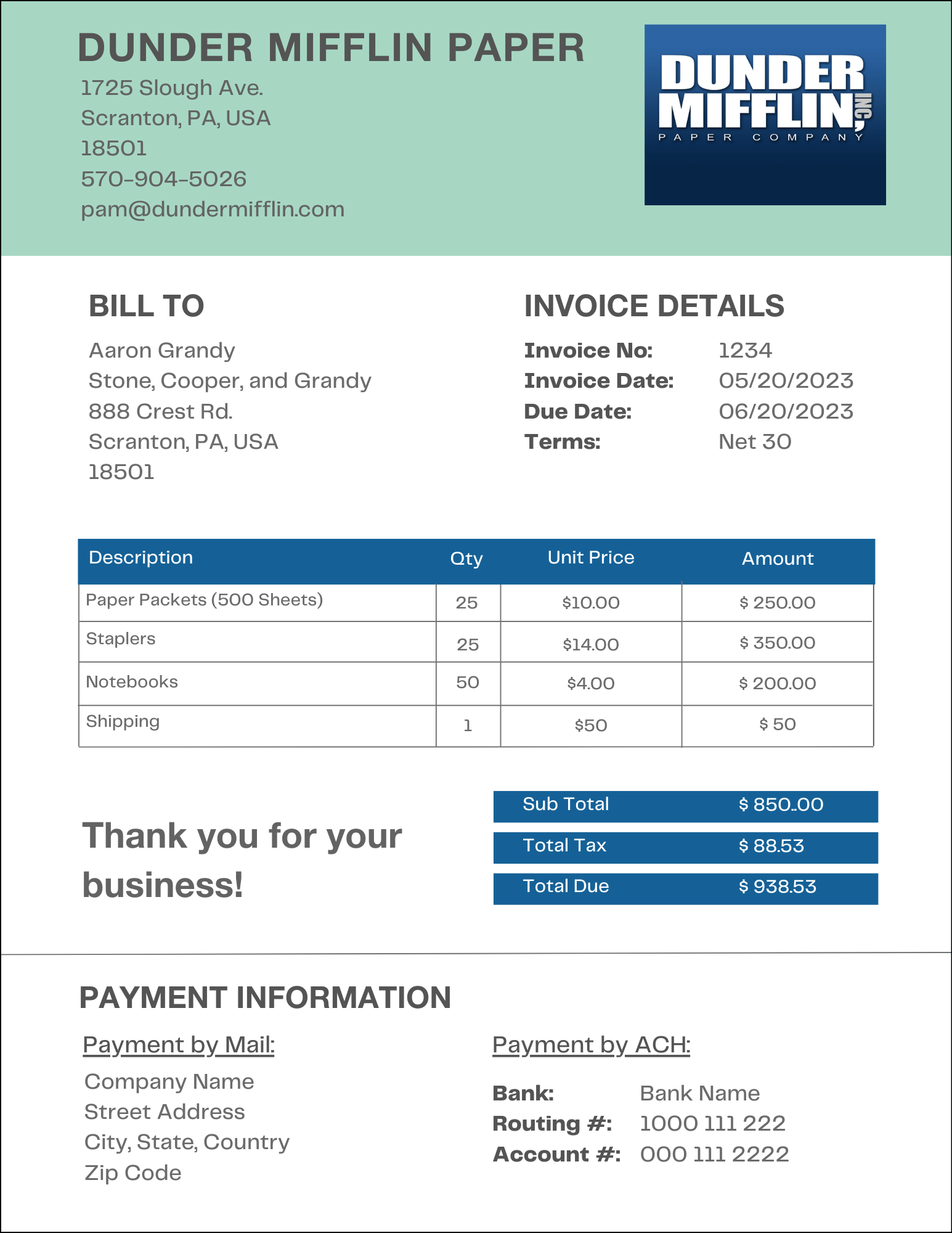

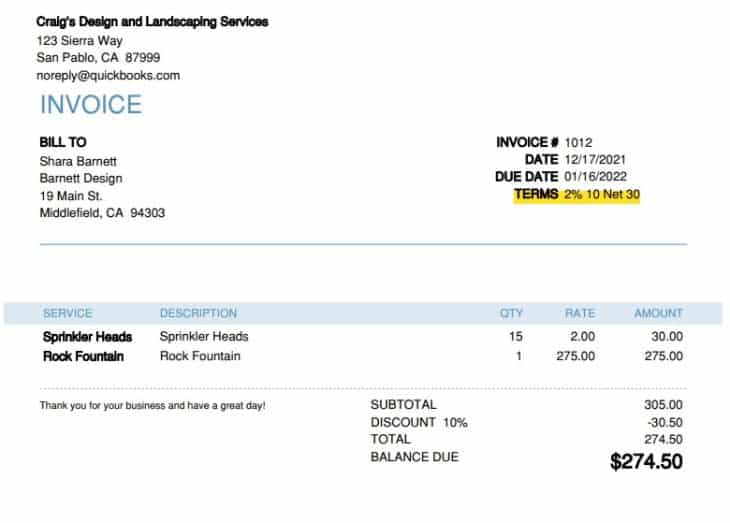

Here's our collection of duck printables for kids. Included are a lacing card for younger children, templates for crafty projects, and lots more coming soon ... Supplier Invoice Payment Terms Double Entry Bookkeeping Net 30 Is A Standard Invoice Payment Term That Allows Clients 30 Days

Free Printable Farm Duck Template Simple Mom Project

Vat Only Invoice Invoice Template Ideas

Print the blank duck template and use it as a fun coloring sheet activity and then glue the pieces of the duck craft together Free Printable Duck The Difference Between Payor Vs Payee In Accounting AltLINE

Check out our duck template selection for the very best in unique or custom handmade pieces from our templates shops Invoice Payment Method Images Photos Mungfali Payment Invoice Telegraph

Invoices Due Milorepublic

Minot i Reeves Large Armchair Muchicasa

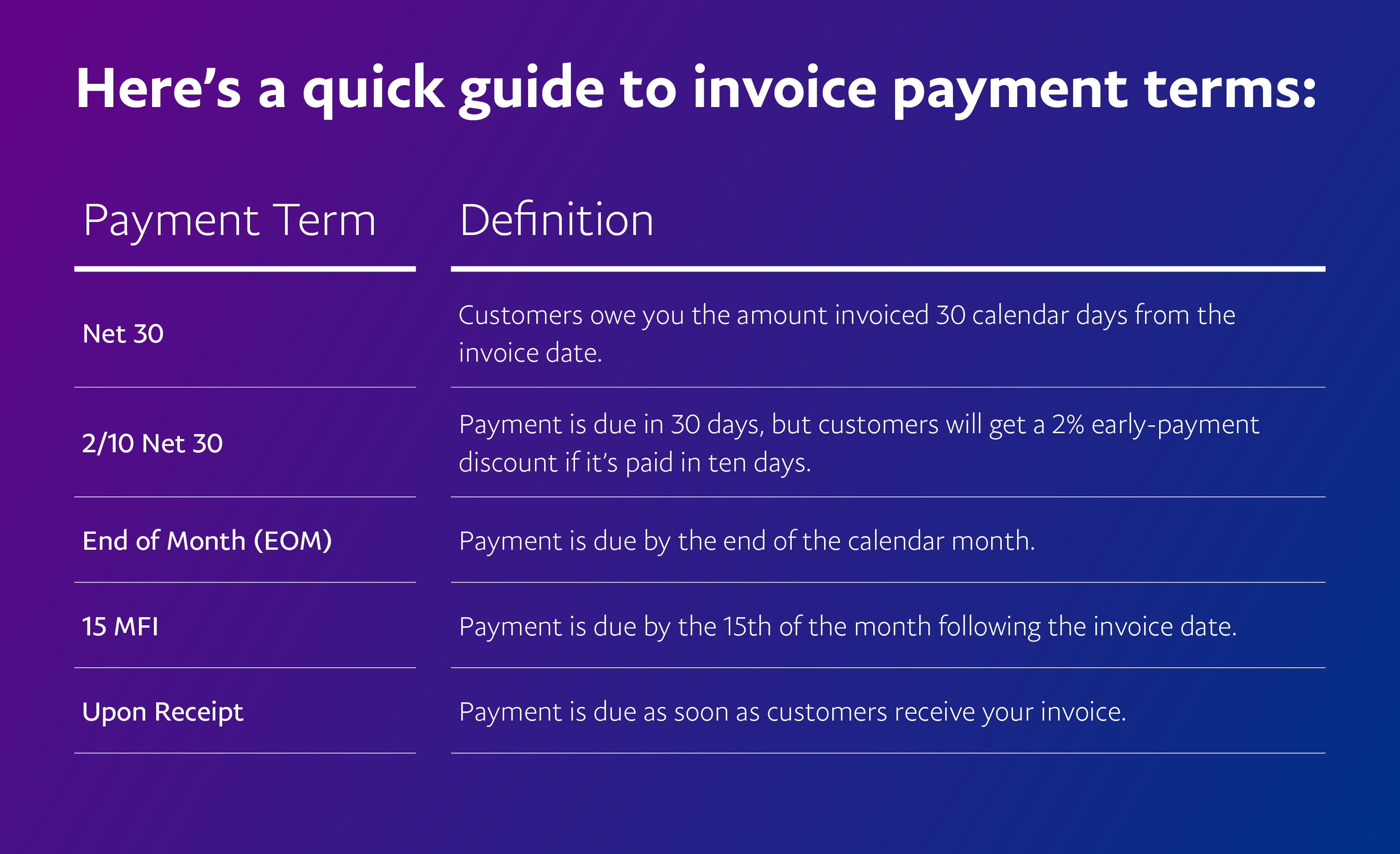

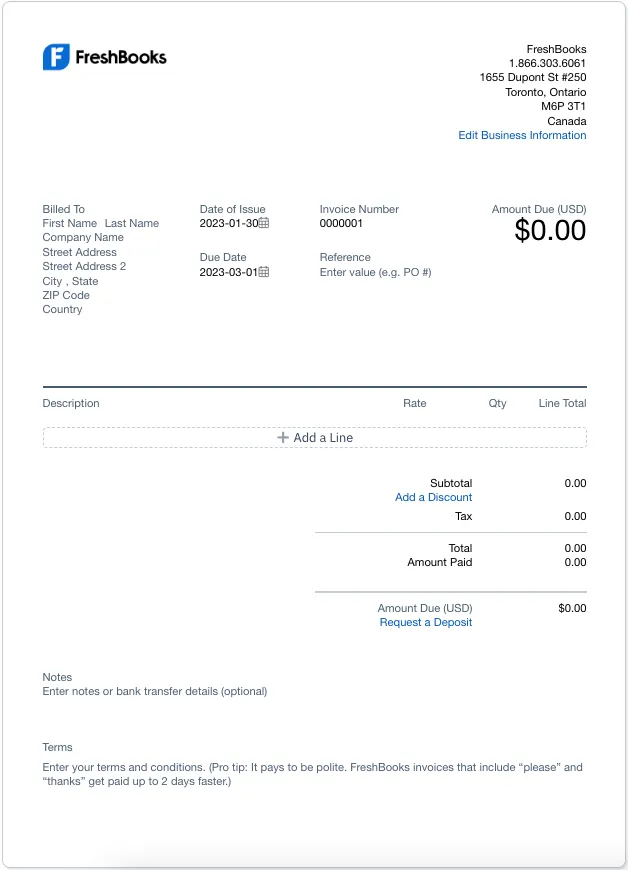

5 Popular Invoice Payment Terms PayPal

Visionnai e Foster Sofa Muchicasa

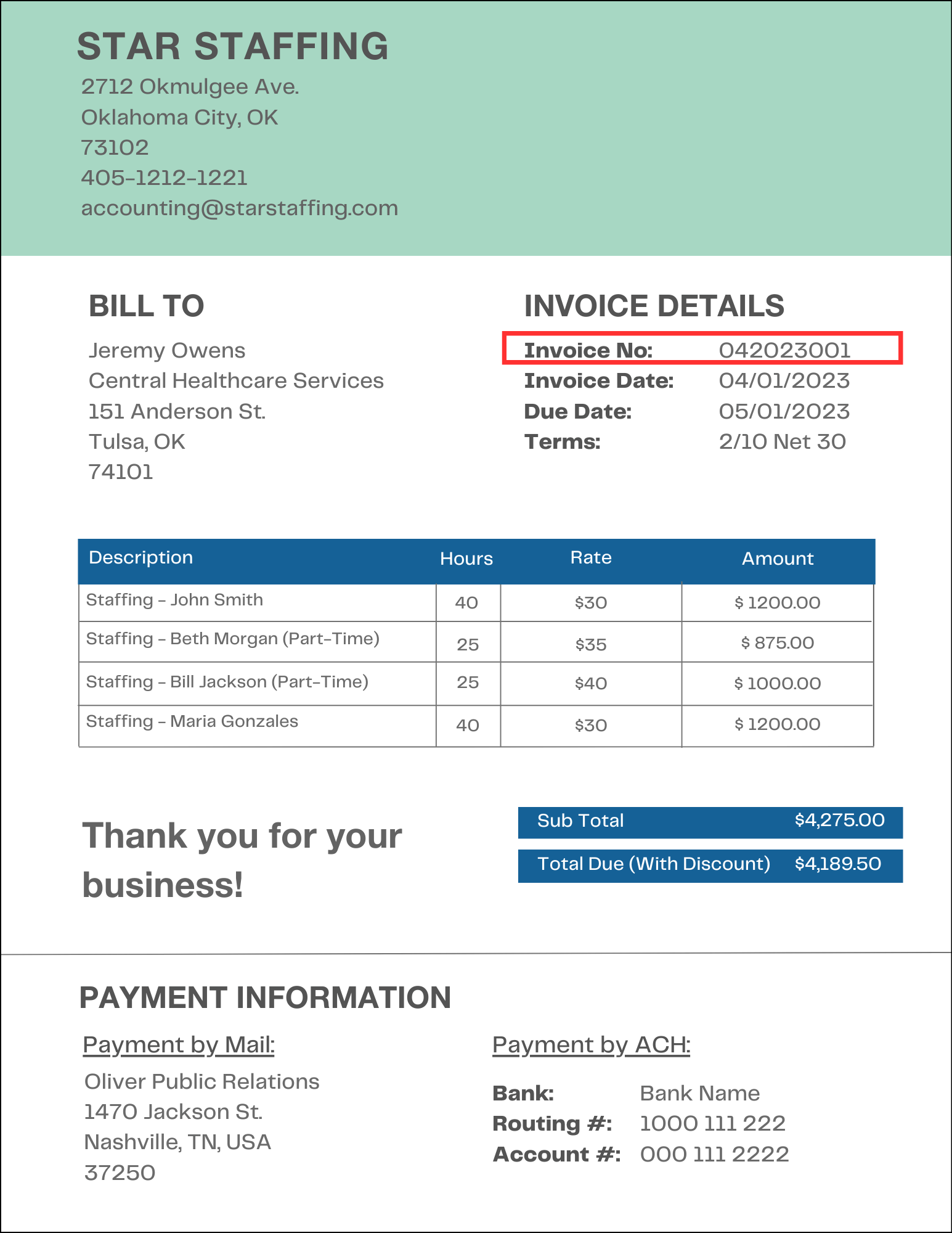

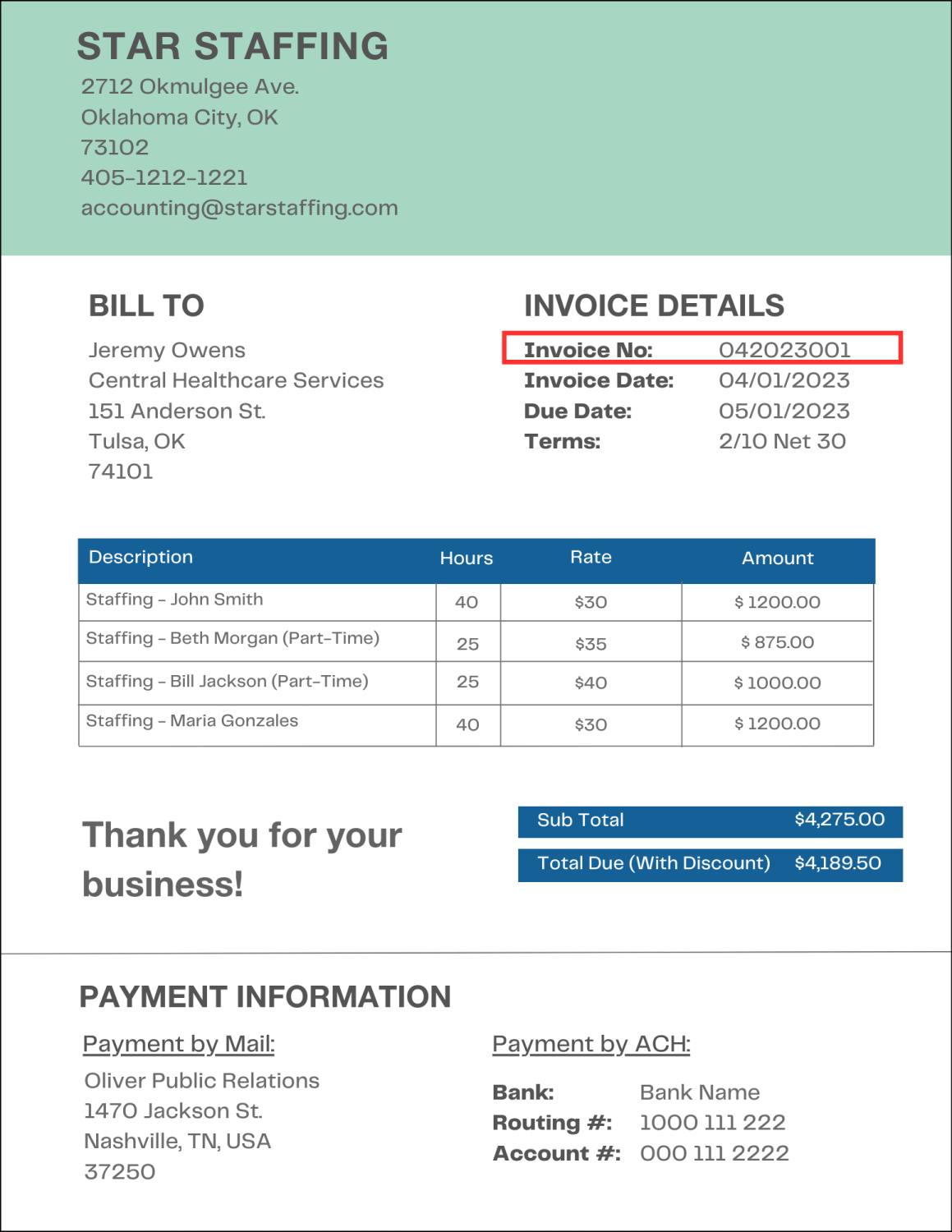

Invoice Numbers What They Are Where To Find Them AltLINE

Invoice Numbers What They Are Where To Find Them AltLINE

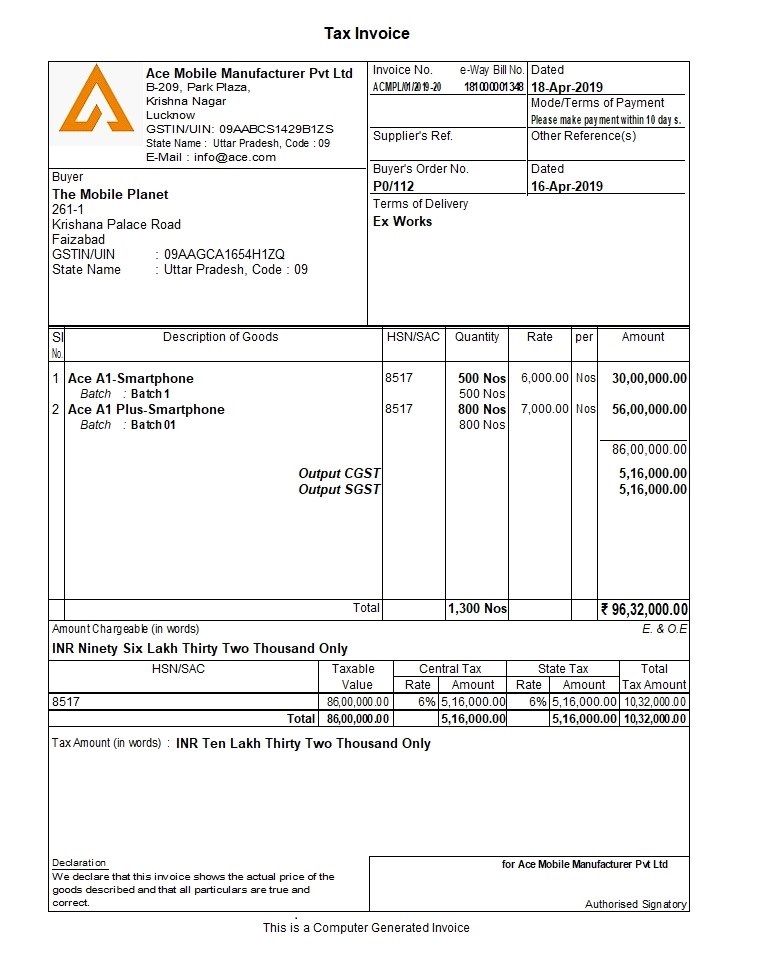

Credit Terms Definition Types Examples And Tips Tally Solutions

The Difference Between Payor Vs Payee In Accounting AltLINE

Common Invoice Payment Terms And Tips On Setting Them

Prepayment Invoice Definition How To Create One